26th March 2019 – What a day it was! We saw a sharp up move of close to 2% points in BN index, quite large a recovery. Today’s open will decide if the trend will sustain or not.

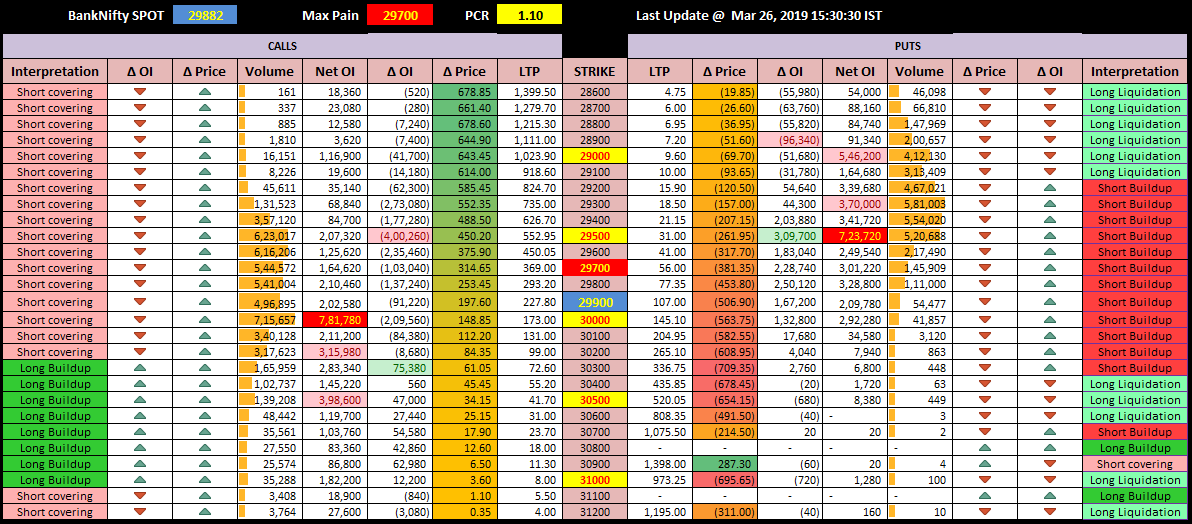

Option chain – (28th March expiry) – Major short covering happened across CEs. 30000, 30200 and 30500 acts as the resistance on the CE side while 29000, 29300 and 29500 act as support. Also, the key levels to watch for – 29412, 29584, 29756, 29929, 30102, 30276

Range – 29500 to 30000

Max Pain – 29700 (D-1: 29400, D-2: 29700, D-3: 29500, D-4: 29700, D-5: 29400)

PCR – 1.10

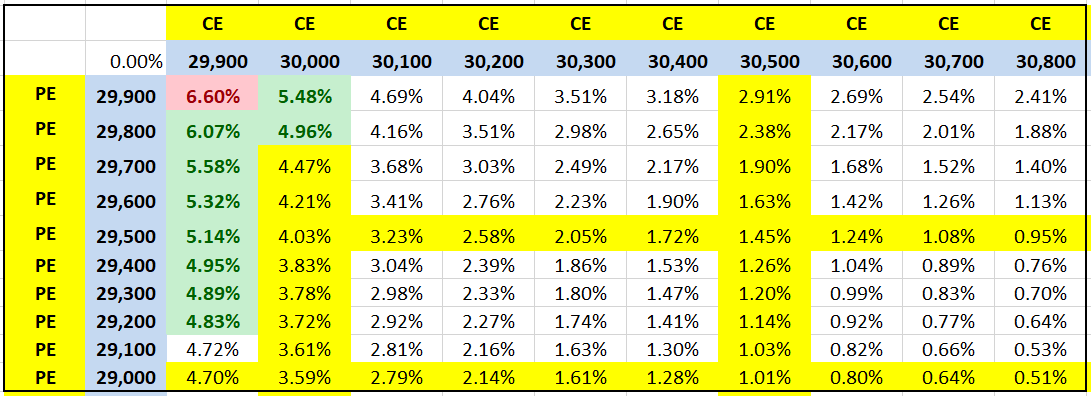

Strangle and Straddle Returns Table

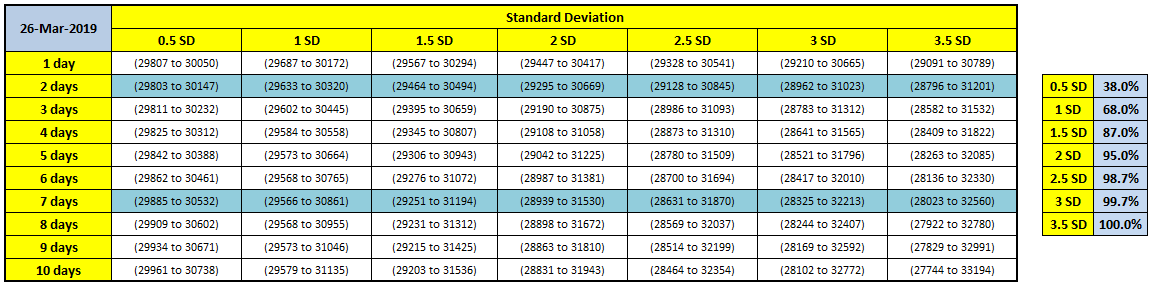

BankNifty BN expected movement with 0.5 SD to 3.5 SD (Reference – Previous day’s closing price)

Join our WhatsApp group now to get live updates about BankNifty BN Option Chain Analysis and more! Learn option trading and start earning a passive income