25th March 2019 – We witnessed a day full of weakness. There was a major sell off all sectors/stocks. Global factors (recession and uncertainty around Brexit) has caused investors to dump all holdings and exit the markets.

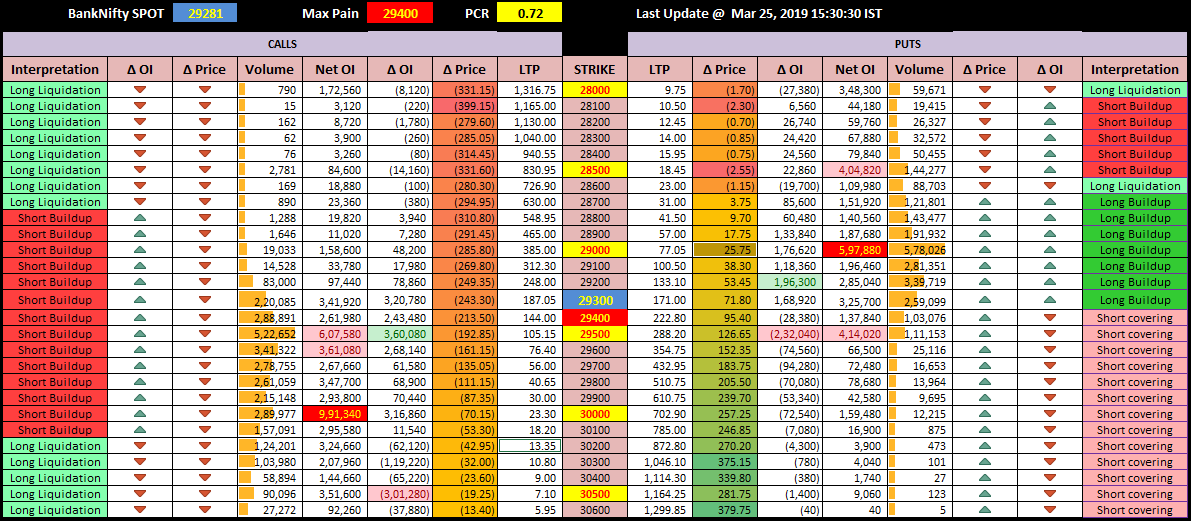

Option chain – (28th March expiry) – Major addition of OI across the ATM and ITM options (29300 to 29600) on the CE side. Short covering at 29500 PE levels (fear of losing more money). 29500, 29600 and 30000 acts as the resistance on the CE side while 28500, 29000 and 29500 act as support. Also, the key levels to watch for – 28985, 29070, 29156, 29241, 29327, 29412, 29498

Range – 29000 to 30000

Max Pain – 29400 (D-1: 29700, D-2: 29500, D-3: 29700, D-4: 29400, D-5: 29300)

PCR – 0.72

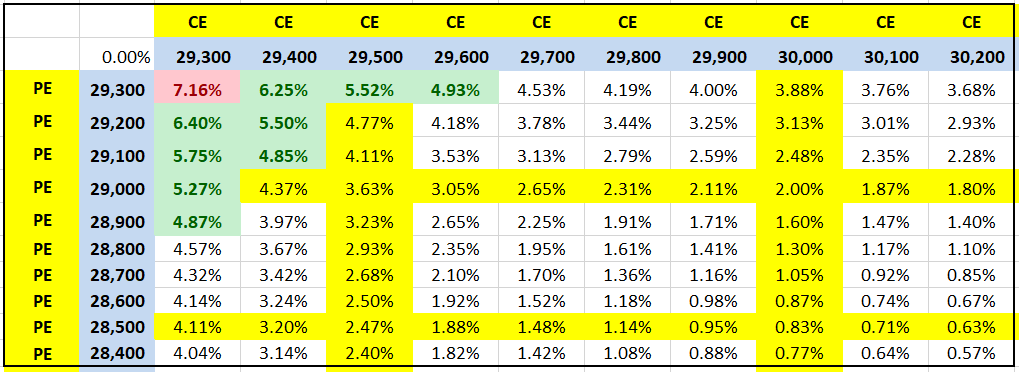

Strangle and Straddle Returns Table

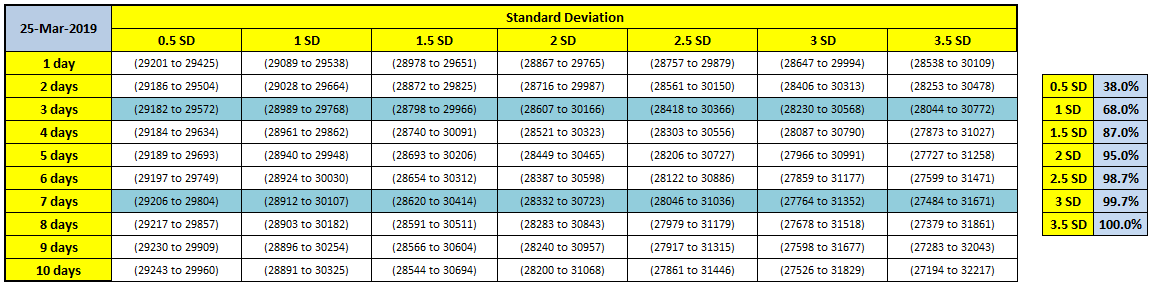

BankNifty BN expected movement with 0.5 SD to 3.5 SD (Reference – Previous day’s closing price)

![]() Join our WhatsApp group now to get live updates about BankNifty BN Option Chain Analysis and more! Learn option trading and start earning a passive income.

Join our WhatsApp group now to get live updates about BankNifty BN Option Chain Analysis and more! Learn option trading and start earning a passive income.