20th March 2019 – It was a very quiet expiry for BankNifty as the index moved within a 150 point range. Hence the option writers made the most out of this expiry. 29850 (FIBO 2) was a strong resistance for BN on the expiry date.

What a rally it was! BN had moved almost 2000 points in the previous 10 sessions. Markets move upwards in the longer run. Let us hope markets sustain these levels during this volatile period.

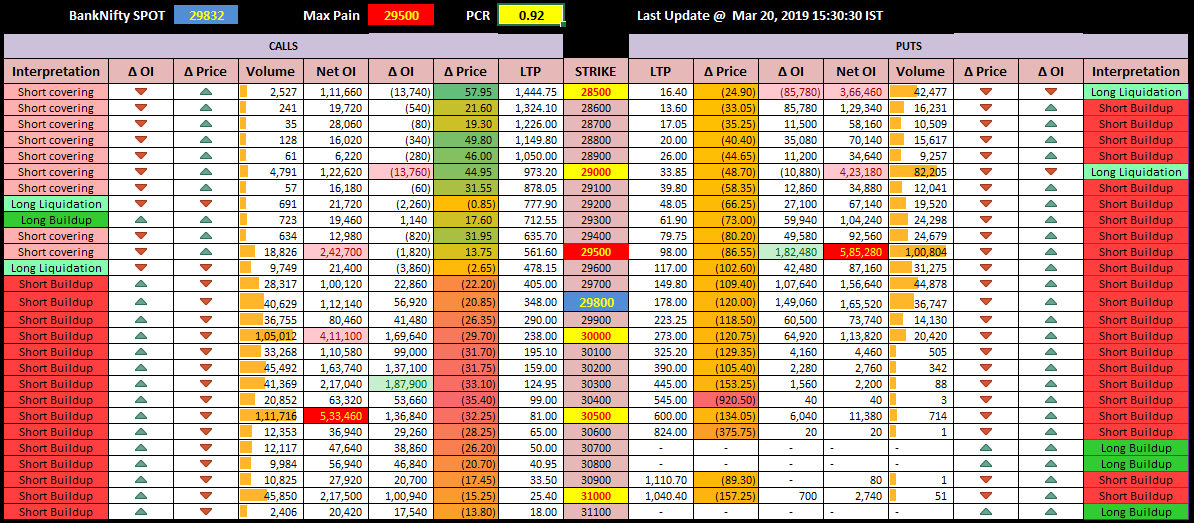

Option chain – (28th March expiry). Since it is the beginning of the expiry, writers wrote at almost all the strikes, majorly mutliples of 500. 29500, 30000 and 30500 act as the resistance on the CE side while 28500, 29000 and 29500 act as support. Also the key levels to watch for – 29584, 29670, 29756, 29843, 29929, 30016, 30102

Range – 29500 to 30500

Max Pain – 29500 (D-1: 29700, D-2: 29500, D-3: 29300, D-4: 28700, D-5: 28300)

PCR – 0.92

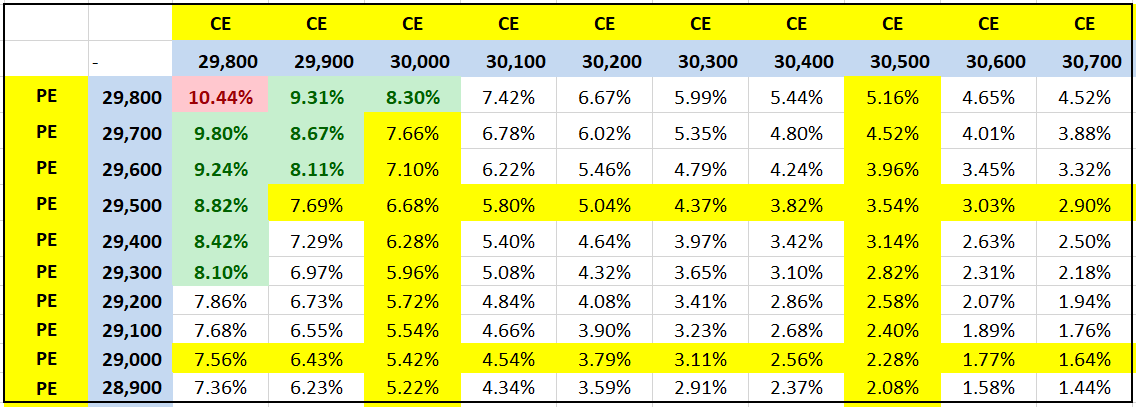

Strangle and Straddle Returns Table

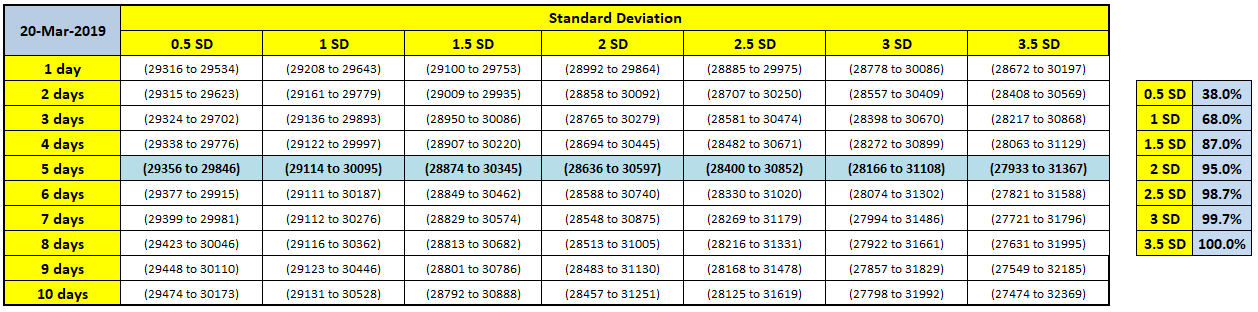

BankNifty BN expected movement with 0.5 SD to 3.5 SD (Reference – Previous day’s closing price)

Join our WhatsApp group now to get live updates about BankNifty BN Option Chain Analysis and more!