We have been updating the BankNifty Standarad Deviations table on a daily-basis. Here’s a post on what it is and how it can be leveraged at the start of the day.

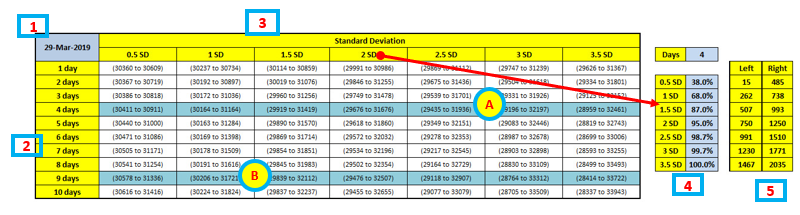

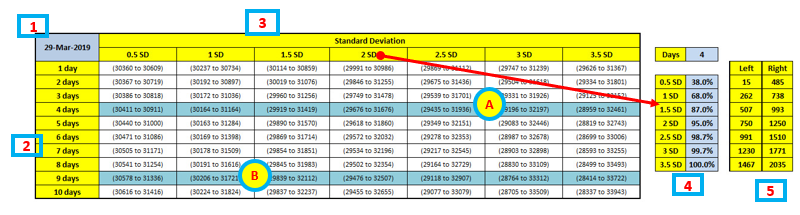

Here’s a sample image generated at the end of day, 29th March 2019 (The previous day’s close was at 30,420. Banknifty closed at 30,426 with a movemnt of just 6 points)

Explanation

1 – Current Date or Date on which the table is generated

2 – Number of trading (days to expiry) – This table can be extended further. For simplicity we have restricted to 10 trading days. This table will IGNORE weekends and other trading holidays

3 – Standard Deviation values – We have populated from 0.5 SD to 3.5 SD. Deviation refers to how far the numbers are spread. Which means, how far the BankNifty index (or Nifty or any other stock) can move in either direction in a few days. Here’s a basic read on Standard Deviation

4 – Table 4 is associated with 3. For each SD there is a likelihood associated with it. Which means if you take 2 SD, chances that BN will close the corresponding range is 95%

5 – Range on the PE side and Range on the CE side. It can be seen that BN has moved drastically in the past 10 odd trading sessions, and hence very high positive values for right side (CE side) and low negative values for left side (PE side)

A, B – Have been highlighted to indicate the 4th April expiry and 11th April expiry, these are 4 and 9 trading days away respectively.

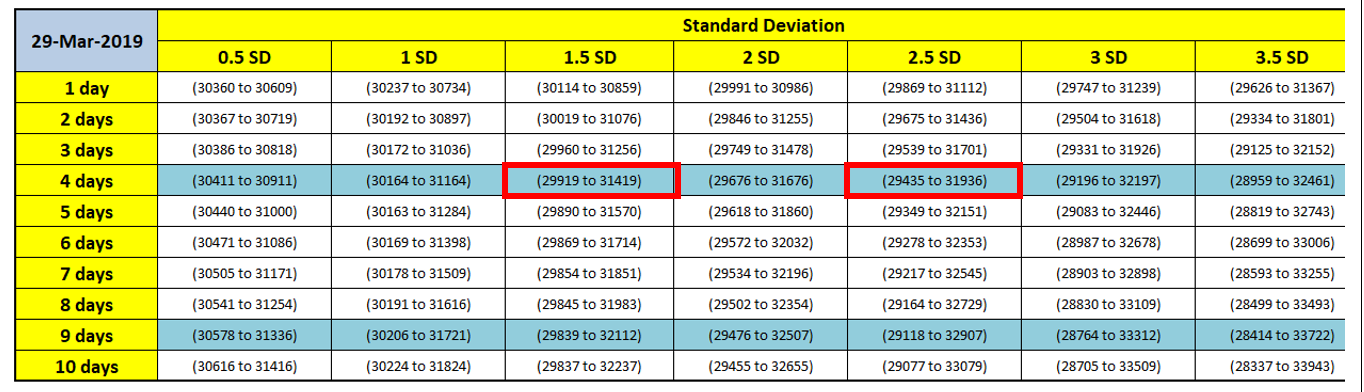

Example

Consider the First Red box

Trading days – 4

SD – 1.5 SD which is 87%

Range – 29919 to 31419

Meaning – Banknifty will more likely stay between/ close in the range 29919 to 31419 in 4 trading days (expiry on 4th April 2019) with 87% accuracy/ confidence

Consider the Second Red box

Trading days – 9

SD – 2.5 SD which is 98.7%

Range – 29435 to 31936

Meaning – Banknifty will more likely stay between/ close in the range 29435 to 31936 in 9 trading days (expiry on 11th April 2019) with 98.7% accuracy/ confidence

It can be noted that the range gets wider as we increase the trading days or standard deviation. We go back to the defintion of Standard Deviation – how far the BankNifty index (or Nifty or any other stock) can move in either direction in a few trading days.

How to leverage this info

Simple! Write options outside this range, depending on your comfort. We have a tool to find the optimal strike pair to sell.

1) Single leg (naked) option selling – Explained here

2) Double leg option selling – Explained here

Please note – This tool/ output is only for educational purpose. Option writing may involve unlimited risk. Do hedge by buying equal lots of PE and CEs as required. Certain brokers may not allow buying far-OTM options due to OI restrictions. Use it at your own risk!

![]() Join our WhatsApp group now to get live updates about BankNifty BN Option Chain Analysis, Returns, New enablers for trading and more!

Join our WhatsApp group now to get live updates about BankNifty BN Option Chain Analysis, Returns, New enablers for trading and more!

Our performance since 1st October can be seen here. We booked close to 51% (over a capital of 15 L) in 6 months. We provide free training for options traders. Learn option trading and start earning a passive income, make your own fortune!

Please post your comments/ feedback in the section below. Thanks.

Is 2nd example referring to correct range, if we are considering 9 days then with 2.5 SD then range should be referred (29118 to 32907). Please correct me if I am wrong.

Hey it depends on the time period you have chosen. What did you choose?

Pingback: BankNifty BN Option Chain Analysis, Strangle Straddle Returns, Expected Movement – 24th February 2020 – NiftyBankNifty.com

Pingback: BankNifty BN Option Chain Analysis Strangle Straddle Returns Expected Movement 19th October 2020 – NiftyBankNifty.com

Pingback: BankNifty BN Option Chain Analysis, Strangle Straddle Returns, Expected Movement – 26 November 2019 – NiftyBankNifty.com

test comment

Pingback: BankNifty BN Option Chain Analysis Strangle Straddle Returns Expected Movement 3rd November 2020 – NiftyBankNifty.com

Pingback: BankNifty BN Option Chain Analysis Strangle Straddle Returns Expected Movement 4th November 2020 – NiftyBankNifty.com

Pingback: BankNifty BN Option Chain Analysis Strangle Straddle Returns Expected Movement 6th November 2020 – NiftyBankNifty.com

Pingback: BankNifty BN Option Chain Analysis Strangle Straddle Returns Expected Movement 9th November 2020 – NiftyBankNifty.com

Pingback: BankNifty BN Option Chain Analysis Strangle Straddle Returns Expected Movement 10th November 2020 – NiftyBankNifty.com

Pingback: BankNifty BN Option Chain Analysis Strangle Straddle Returns Expected Movement 11th November 2020 – NiftyBankNifty.com

Pingback: BankNifty BN Option Chain Analysis Strangle Straddle Returns Expected Movement 12th November 2020 – NiftyBankNifty.com

Pingback: BankNifty BN Option Chain Analysis Strangle Straddle Returns Expected Movement 18th November 2020 – NiftyBankNifty.com

Pingback: BankNifty BN Option Chain Analysis Strangle Straddle Returns Expected Movement 19th November 2020 – NiftyBankNifty.com

Pingback: BankNifty BN Option Chain Analysis Strangle Straddle Returns Expected Movement 20th November 2020 – NiftyBankNifty.com

Pingback: BankNifty BN Option Chain Analysis Strangle Straddle Returns Expected Movement 23rd November 2020 – NiftyBankNifty.com

Pingback: BankNifty BN Option Chain Analysis Strangle Straddle Returns Expected Movement 24th November 2020 – NiftyBankNifty.com

Pingback: BankNifty BN Option Chain Analysis Strangle Straddle Returns Expected Movement 27th November 2020 – NiftyBankNifty.com