Our 1% per week strategy has been explained here –https://niftybanknifty.com/question/share-your-options-trading-strategy/ . This strategy explains how one can leverage selling far-OTM options to make a consistent and passive income. Now, the larger questions are

- How to identify the right strike price(s) to sell

- Do we need a hedge to protect the sell positions

- How to identify the strikes to use as a hedge

We have been doing some analysis on identifying the right options to sell, with a hedge.

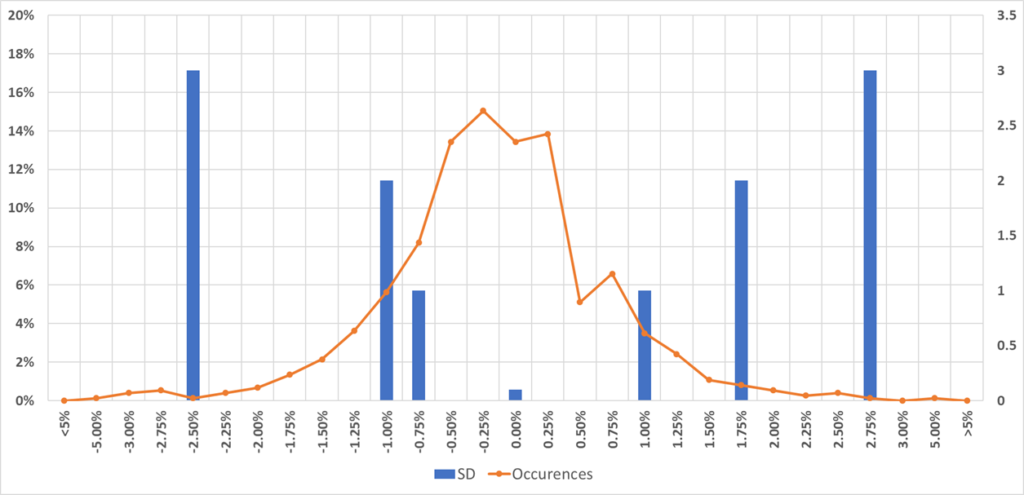

Considering 30 legs on PE side and 30 legs on CE side, the total combinations for options is approx a million! A lot of these combinations are meaningless and the number reduces to a few lakhs. A further ‘meaningful’ guess can reduce the number to a few thousand! Choosing a few combinations is the key!

The following parameters have been considered –

- Strike to sell (CE/PE)

- Strike to be used as hedge (CE/PE)

- Whether it needs to be made delta neutral (PE/CE)

- Hedge for the other leg (PE/CE)

- Risk Reward ratio

- Probability of profit

- Distance between sell leg and hedge (every 100 points corresponds to 4% of your capital, and if you use more leverage to take intra day positions it can go as high as 10%, and is very risky)

- Bid Ask spread for far OTM contracts

- Liquidity (closely linked with bid-ask spread)

- Broker you use

The plan

Note – All values taken as of EOD 10th May 2019. BN was trading at 29040, VIX 26.34, Nifty at 11278. We are considering May 30th series only.

For the CE side

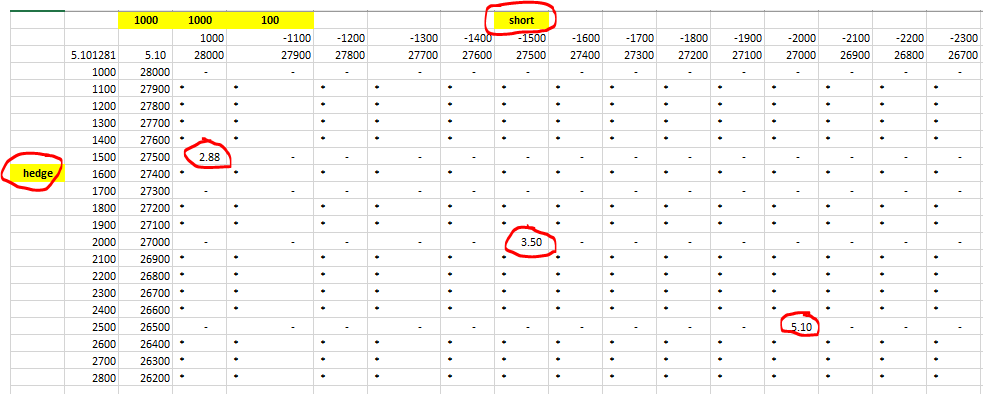

Consider this image. The row has strikes for short and column has strikes to be used as hedge. In this case we can safely sell an option at 2400 points away from strike i.e. 31600 CE and take a hedge at 31800 CE.

The risk reward is 2.37. If BN is within this 2400 point range from today, ROI is 2.08%. If there is an extreme good news coz of elections/ investor sentiments, assuming BN surges beyond 2400 points to say 33000 (highly unlikey!!!), still at max one loses 4.94%.

This setup is very safe in my opinion.

For the PE side

Similar funda for PE side. Legs to short and take hedge as per risk apetite. Let us consider 27000 PE short and 26500 PE buy as hedge.The protection is 2000 points on the downside.

Risk reward is 5.1. Best case around 1% ROC. Exit polls have indicated a win for party A, but they may not have majority to form government. Speculations around trade war between US-China.

All put together, this setup is little risky.

Combining CE and PE side – (Condor, Butterfly)

CE side risk reward is 2.37, ie. best case you gain Re. 1 and worst case you lose Rs. 2.37.

PE side risk reward is 5.1, so you win 1 or lose 5.

If BN settles within -2000 to +2400 points by May end, both legs will be profitable. In the worst case (up move/down move), you will win on one side and lose on the other, this effectively brings down the risk-reward ratio 🙂

One of the important aspects in this setup is that you should be able to buy far OTM options and hence the push for a broker like Upstox. Clearly, it is a no-brainer that Zerodha will be little help in this case, as they hit the OI restrictions pretty soon. If you are interested to open a free Demat account, kindly use the following link – http://upstox.com/open-account/?f=V44K.

Once you open an account with us, we will add you to a group where we can discuss live trades.

Some useful stuff you may want to check out –

1) Top 3 OI levels are being posted on our telegram channel. You can use this to identify the OI levels (Strikes) that act as support and resistance. Link to the telegram channel – t.me/niftybankniftyoptionselling

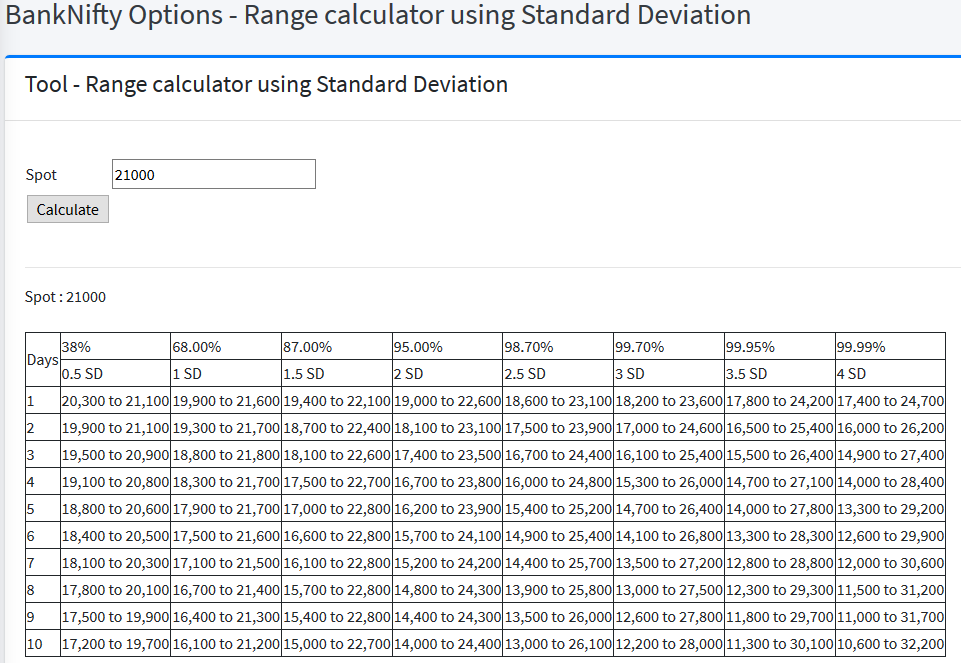

2) You can use this tool to arrive at the Probability of Profit (POP) – https://tools.niftybanknifty.com/banknifty-range-using-standard-deviation.php

Also, if you are a good chart reader, you can identify trends (say using Pivot, SR levels etc) and choose to operate on one side – say CE or PE side. And close to ‘event’ days, better not to trade! Sometimes a no-trade is a good trade!

Join our Telegram group now to get live updates about BankNifty BN Option Chain Analysis and more!

Join our Telegram group now to get live updates about BankNifty BN Option Chain Analysis and more!

![]() Join our WhatsApp group now to get live updates about BankNifty BN Option Chain Analysis and more! Learn option trading and start earning a passive income.

Join our WhatsApp group now to get live updates about BankNifty BN Option Chain Analysis and more! Learn option trading and start earning a passive income.

hi, ‘

can you share me your email id please

Dear Ragu

Is there any option of placing CE and PE sell orders at same time as single trade at your broking.

Do we have to do adjacent ment trade to protect losss or t increase profit

If we invest 10 lakhs can we earn more than 35000 per month

Thangavelu

Dear Thangavelu, Yes, we have an option to place basket orders. You can trade to expect 1% per week provided if you follow proper risk management techniques.

1% of profit compare to what amount.. Diff brokers using diff margin, can u pl. Advice an example..