There are few key parameters that contribute to a option writing system

- Spot value

- Time of entry

- Time of exit (or Target/ Trailing SL/ Loss SL)

- Distance of CE and PE legs on both sides

- Weekday (Friday, Monday etc)

- Time to expiry

- Other parameters – Greeks, Volatility/VIX , OI etc

I have been crunching BankNifty options data for the past few quarters, trying to find the ideal setup. I got the following matrix –

All the numbers are absolute BankNifty points (premium increase/ erosion) per day.

For BankNifty setup (and Zerodha broker), 1 point is approximately 2 bips. 50 points is 1% on your traded capital.

How to read this table –

Loss days – Number of days when you would have incurred loss

Min profit – Max loss if you dont have a SL. The min profit is as low as -619, which is 12% of trading capital getting wiped out if you do not have a SL, during major moves!

Average profit – Average profit if you dont have a SL

Maximum profit – Maximum Profit

Maximum profit with SL

Average profit with SL – Average profit if you square off positions at a defined SL

I have been using this matrix in various other forms (different SL, entry points, distance from strike etc), and I entered at 400 points away from SPOT today. The expected points is 70 point per day if you implement a strict SL.

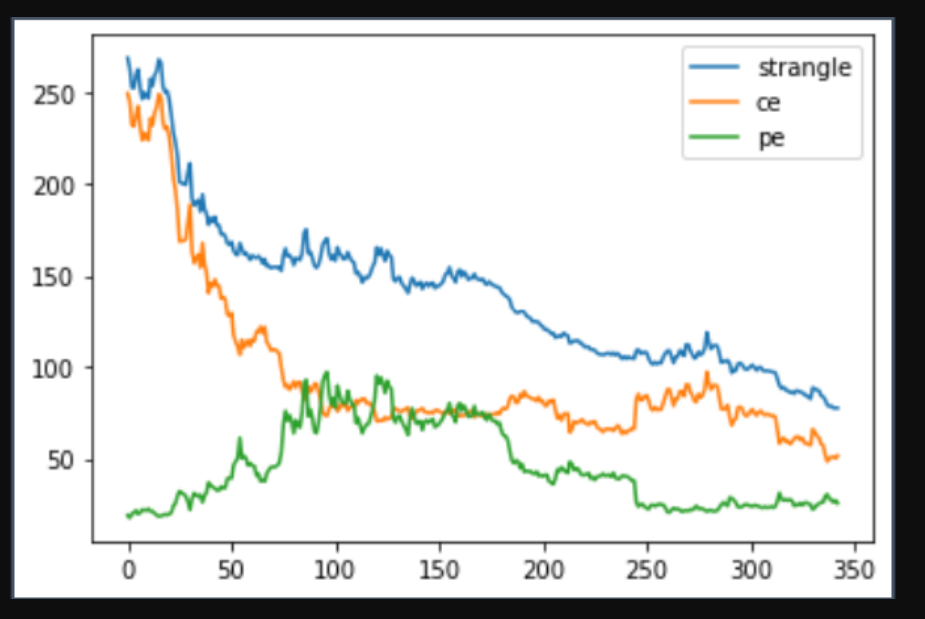

The sum of the combined premium when I entered was 170 and if you check the screenshot when the image was taken (2021-08-11 14:51), the combined premium is as low as 87 points (or 83 point decay), clearly above the “70 point decay per day” benchmark!

X Axis – Minutes starting from 9:15 Y Axis – Premium CE, PE and Combined (Strangle=CE+PE)

Margin required is approx. 5L and today’s ROI is 0.44% per day!

I am constantly trying to add more parameters to this setup – Top 3 OI, VIX (very hard to crack, but doable), ATR, RSI, Super Trend etc, to remove false positive entries and/or predict big moves that will go against this setup.

Do post your questions and/or comments in our forum or telegram group.

Nice Set-up but but

Spot value

Time of entry

Time of exit (or Target/ Trailing SL/ Loss SL)

Distance of CE and PE legs on both sides

Weekday (Friday, Monday etc)

Time to expiry

Other parameters – Greeks, Volatility/VIX , OI etc

All above points needed for a clear rule based set-up. Do you have designed those rules. Looks promising

Regds

Ramu

Yes, we have the rules for this system

Thanks for the reply… How do I learn this rules. Can you share.,? I am one of your students. I am also there in your whatsapp group. NBN Option selling G5.

Regds

Ramu