5th April 2019 – It was a range-bound and volatile day as BankNifty moved within the 1st upper and lower Fibo levels. Good day for delta-neutral option sellers. BN showed some strength in the final minutes of the week.

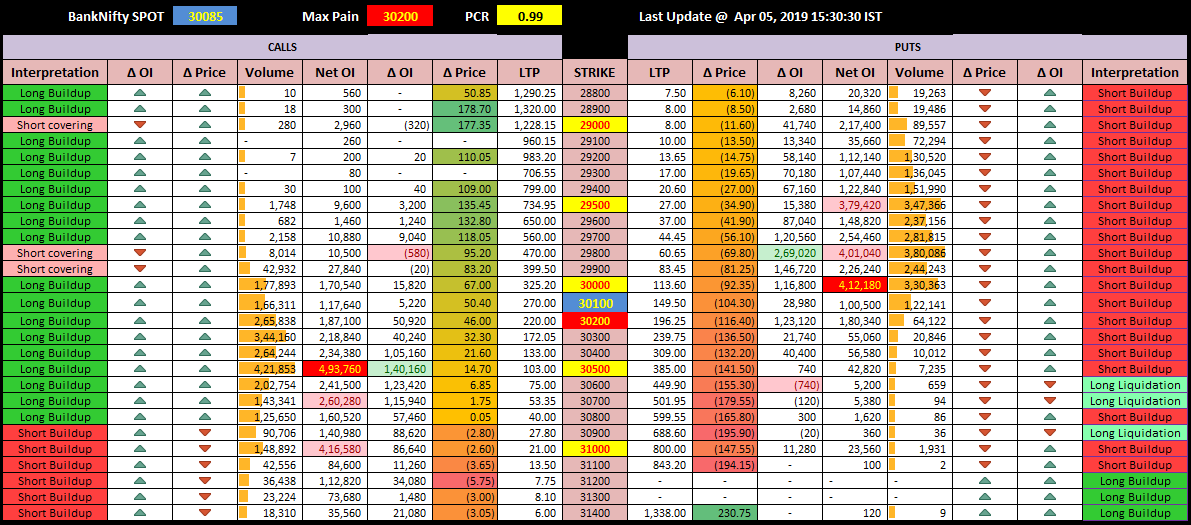

Option chain – (11th April expiry) – More OI added at 30500 CE and 29800 PE levels. 30500, 30700 and 31000 act as the resistance on the CE side while 29500, 29800 and 30000 act as support

Key levels to watch for – 29412, 29584, 29756, 29929, 30102, 30276

Range – 30000 to 30500

Max Pain – 30200 (D-1: 30100, D-2: 30300, D-3: 30300, D-4: 30400, D-5: 30300)

(Explanation to this table here – http://bit.ly/nbn_optionchain). Also, this table is LIVE here – http://bit.ly/nbn_bnoptionchainlive )

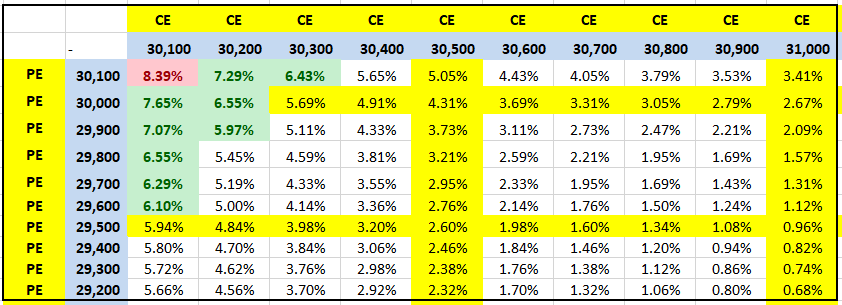

Strangle and Straddle Returns Table

(Explanation to this table here – http://bit.ly/nbn_returnstable ). Also this table is LIVE here – http://bit.ly/nbn_bnreturnstablelive )

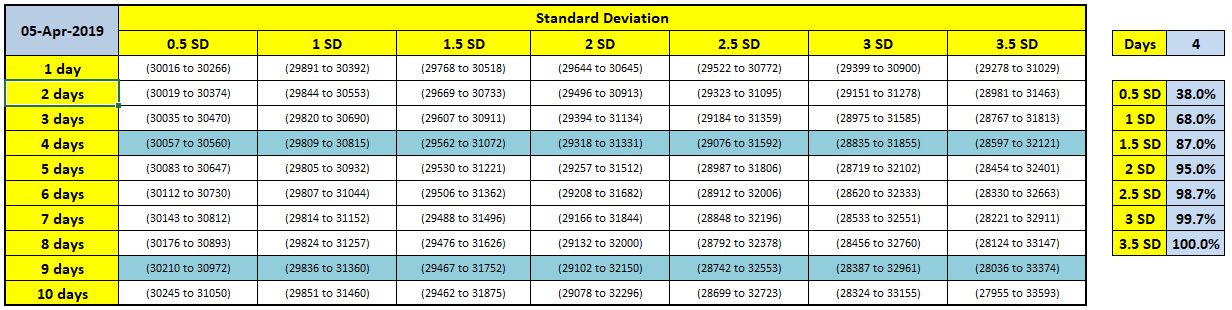

BankNifty BN expected movement with 0.5 SD to 3.5 SD (Reference – Previous day’s closing price)

(Explanation to this table here – http://bit.ly/nbn_bnstandarddeviation ).

For any queries, do post your questions here in our QnA forum here – http://bit.ly/nbn_tradingqna )

![]() Join our WhatsApp group now to get live updates about BankNifty BN Option Chain Analysis and more! Learn option trading and start earning a passive income.

Join our WhatsApp group now to get live updates about BankNifty BN Option Chain Analysis and more! Learn option trading and start earning a passive income.