3rd April 2019 – BankNifty could not sustain the momentum carried forward from the previous days closing minutes. It was range bound till 2 PM. Post this, it showed a clear sign of weakness. Clearly PE writers at 30100 levels incurred loss, as they closed their shorts.

RBI policy outcome is a key event for the volatility tomorrow. The expectation is a reduction of 25 basis points.

Option chain – (4th April expiry) – Good short covering at 30000 to 30500 PEs. There is a strong support at 30000. 30500, 30700 and 31000 act as the resistance on the CE side while 30200, 30000 and 29500 act as support.

Key levels to watch for – 29756, 29929, 30102, 30276, 30450

Range – 30000 to 30500

Max Pain – 30300 (D-1: 30300, D-2: 30400, D-3: 30300, D-4: 30100, D-5: 30000)

PCR – 0.57

(Explanation to this table here – http://bit.ly/nbn_optionchain). Also, this table is LIVE here – http://bit.ly/nbn_bnoptionchainlive )

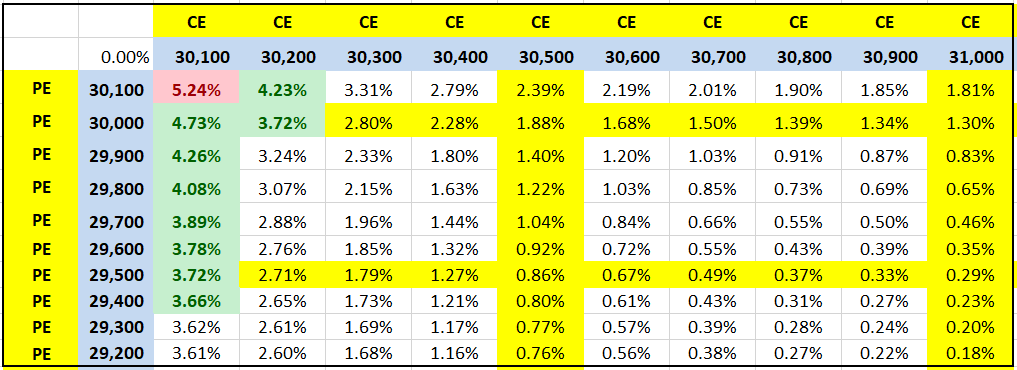

Strangle and Straddle Returns Table

(Explanation to this table here – http://bit.ly/nbn_returnstable ). Also this table is LIVE here – http://bit.ly/nbn_bnreturnstablelive )

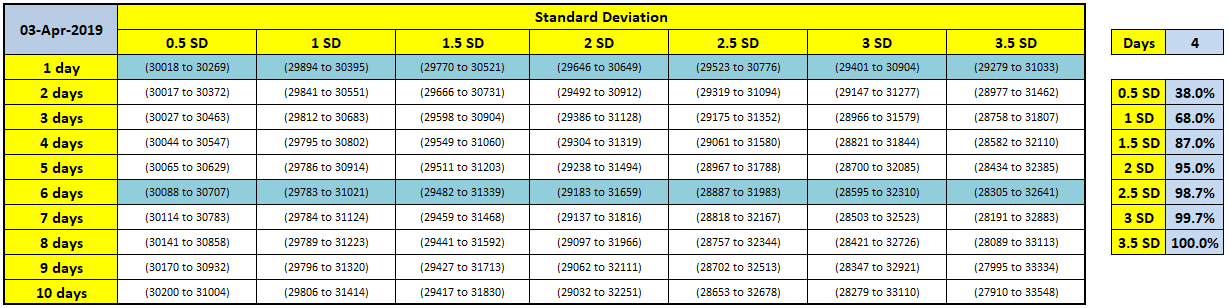

BankNifty BN expected movement with 0.5 SD to 3.5 SD (Reference – Previous day’s closing price)

(Explanation to this table here – http://bit.ly/nbn_bnstandarddeviation ).

For any queries, do post your questions here in our QnA forum here – http://bit.ly/nbn_tradingqna )

![]() Join our WhatsApp group now to get live updates about BankNifty BN Option Chain Analysis and more! Learn option trading and start earning a passive income.

Join our WhatsApp group now to get live updates about BankNifty BN Option Chain Analysis and more! Learn option trading and start earning a passive income.