29th March 2019 – It was a very quiet last day of the week, month and financial year, without BankNifty closing just 6 points above the previous close. BN was within the pivot and the fibo level 1 (on a 15 minute candle). A near-zero movement across all the constituent banks. Really good day for intra-day option sellers.

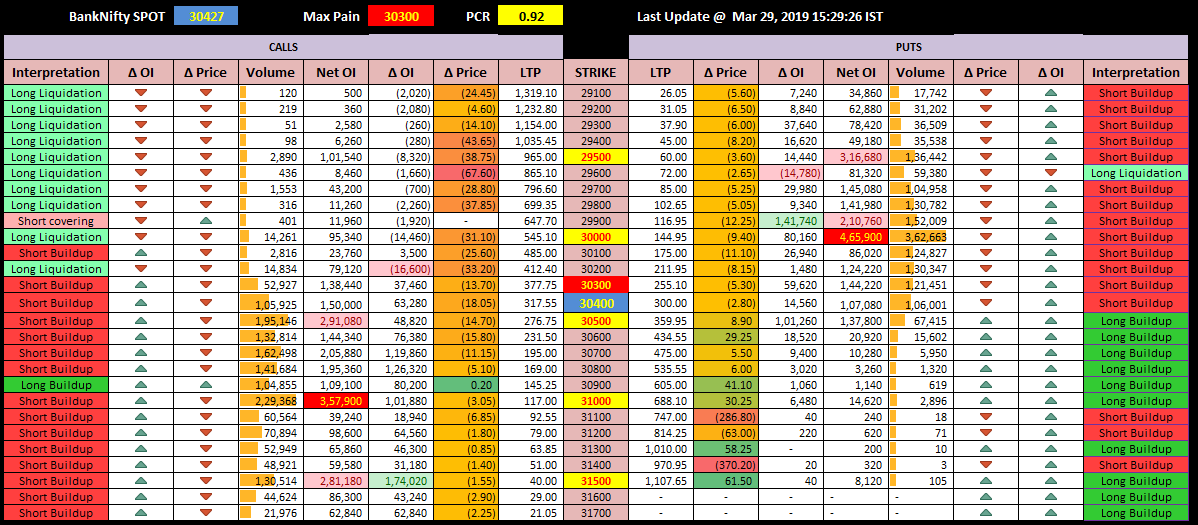

Option chain – (4th April expiry) – No good inference from the option chain tables, as writers were active across the option chain. Majorly multiples of 500 acted as support and resistance. 30500, 31000 and 31500 act as the resistance on the CE side while 30000, 29900 and 29800 act as support.

Key levels to watch for – 29929, 30102, 30276, 30450, 30625, 30800

Range – 30000 to 31000

Max Pain – 30300 (D-1: 30100, D-2: 30000, D-3: 29700, D-4: 29400, D-5: 29700)

PCR – 0.92

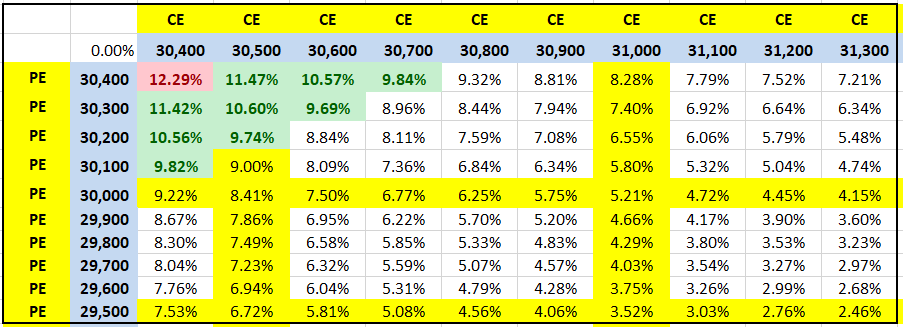

Strangle and Straddle Returns Table

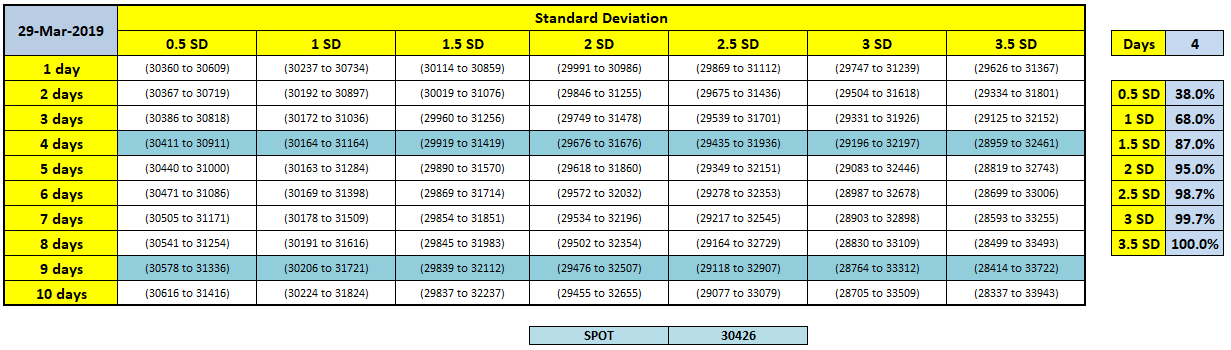

BankNifty BN expected movement with 0.5 SD to 3.5 SD (Reference – Previous day’s closing price)

Join our WhatsApp group now to get live updates about BankNifty BN Option Chain Analysis and more! Learn option trading and start earning a passive income