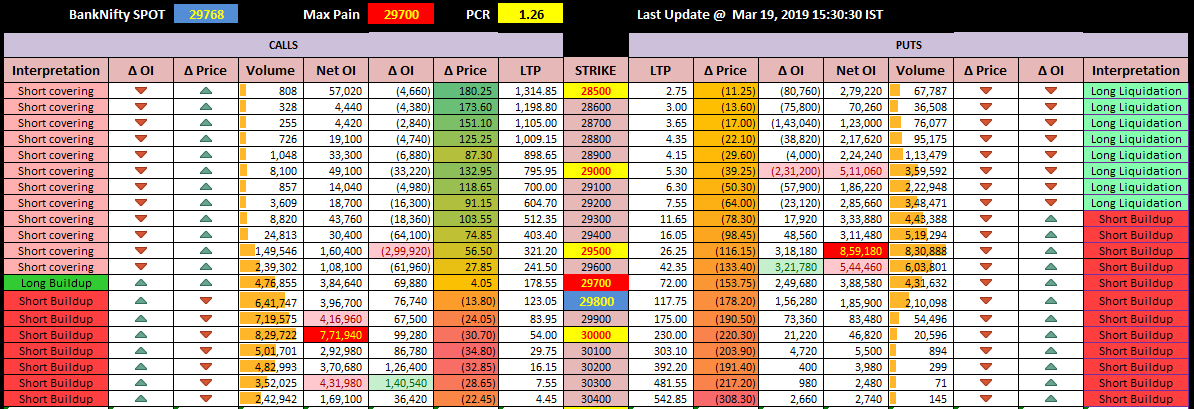

19th March 2019 – The Bull run seemed to have slowed down as BN struggled to go past the Fibo level 1 at 29750. The technicals however shows momentum is still out there for more up move.

Option chain – Very less OI addition across CEs and PEs. ITM CE writes have covered their shorts. PE writers on the other side, have moved to closer OTM strikes after booking profits. 29900, 30000 and 30300 act as the resistance on the CE side while 29000, 29500 and 29600 act as critical support. Also the key levels to watch for – 29498, 29584, 29670, 29756, 29843, 29929, 30016

Range – 29500 to 30000

Max Pain – 29700 (D-1: 29500, D-2: 29300, D-3: 28700, D-4: 28300, D-5: 27900)

PCR – 1.26

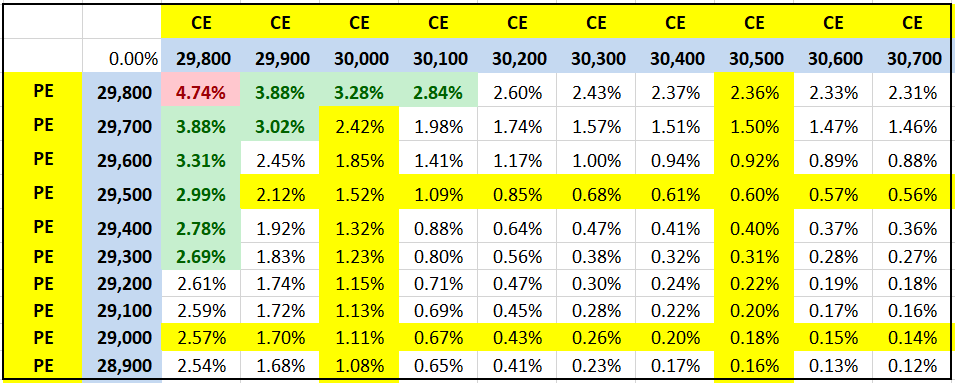

Strangle and Straddle Returns Table

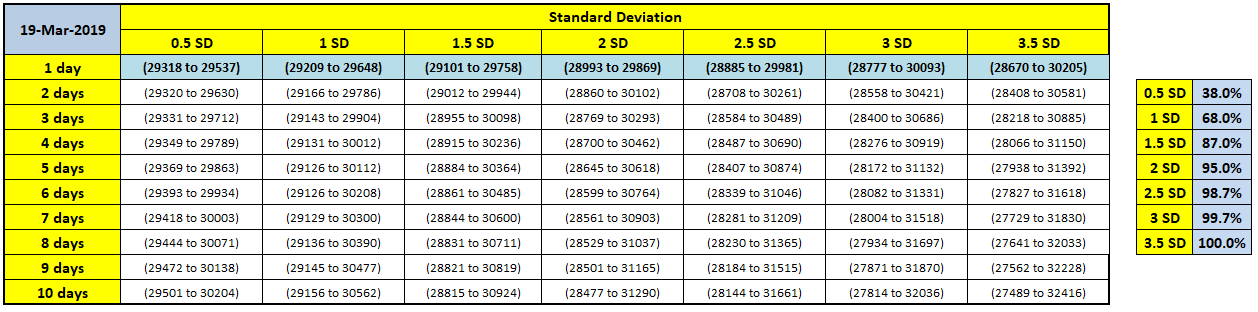

BankNifty BN expected movement with 0.5 SD to 3.5 SD (Reference – Previous day’s closing price)

Join our WhatsApp group now to get live updates about BankNifty BN Option Chain Analysis and more!