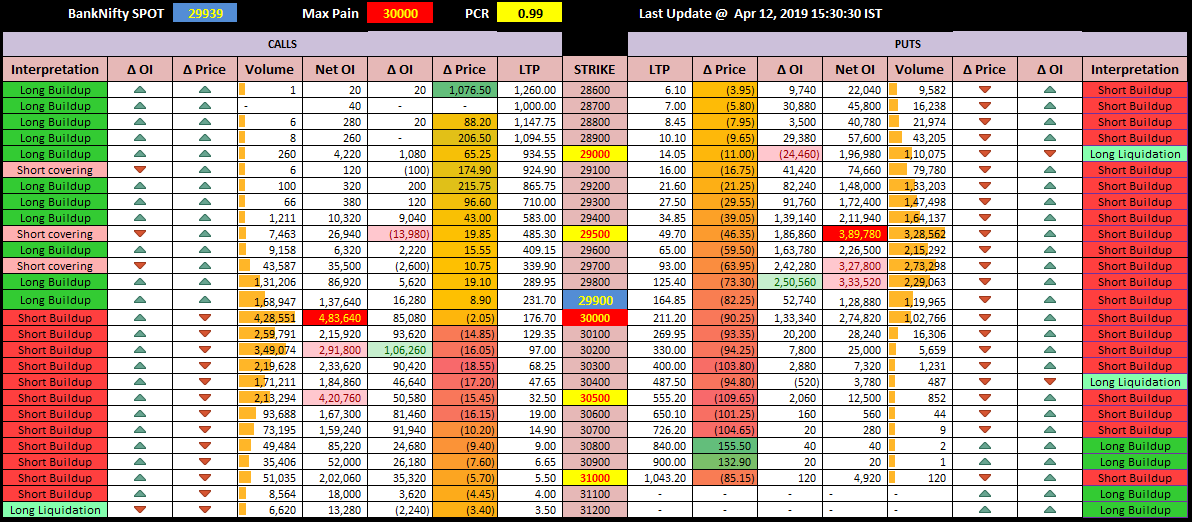

12th April 2019 – Range bound day for BankNifty throughout the day. In the latter half of the day, BN showed some strength because of the strong results of underlying Nifty stocks, but it failed to sustain the momentum.

Option chain – (18th April expiry) – Heavy CE writing at 30200 levels indicating a short term resistance. Similar case with 29800 PEs indicating support. 30000, 30200 and 30500 act as the resistance on the CE side while 29500, 29700 and 29800 act as support

Key levels to watch for – 29412, 29584, 29756, 29929, 30102, 30276

Range – 29500 to 30000

Max Pain – 30000 (D-1: 29900, D-2: 30000, D-3: 30000, D-4: 30000, D-5: 30200)

PCR – 0.99

(Explanation to this table here – http://bit.ly/nbn_optionchain). Also, this table is LIVE here – http://bit.ly/nbn_bnoptionchainlive )

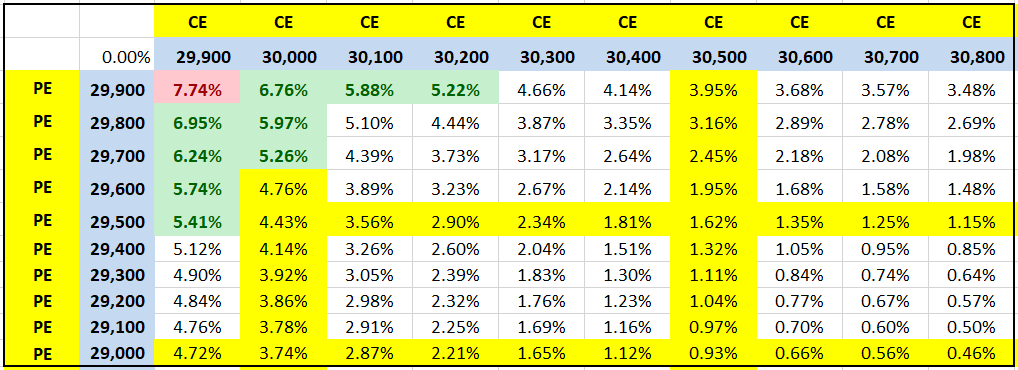

Strangle and Straddle Returns Table

(Explanation to this table here – http://bit.ly/nbn_returnstable ). Also this table is LIVE here – http://bit.ly/nbn_bnreturnstablelive )

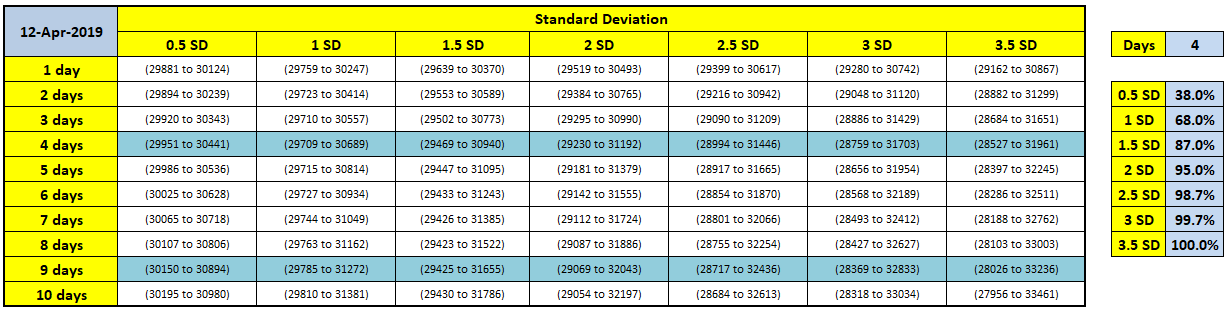

BankNifty BN expected movement with 0.5 SD to 3.5 SD (Reference – Previous day’s closing price)

(Explanation to this table here – http://bit.ly/nbn_bnstandarddeviation ).

For any queries, do post your questions here in our QnA forum here – http://bit.ly/nbn_tradingqna )

![]() Join our WhatsApp group now to get live updates about BankNifty BN Option Chain Analysis and more! Learn option trading and start earning a passive income.

Join our WhatsApp group now to get live updates about BankNifty BN Option Chain Analysis and more! Learn option trading and start earning a passive income.