15th March 2019 – BankNifty gapped up (80 points) and gradually rose up to new highs. The last 30 minutes showed good signs of weakness. The opening range of BN on Monday is very critical how the 20th March expiry week spans out. Throughout this week, the CE writers have been on the run to close their bleeding positions because of the up move.

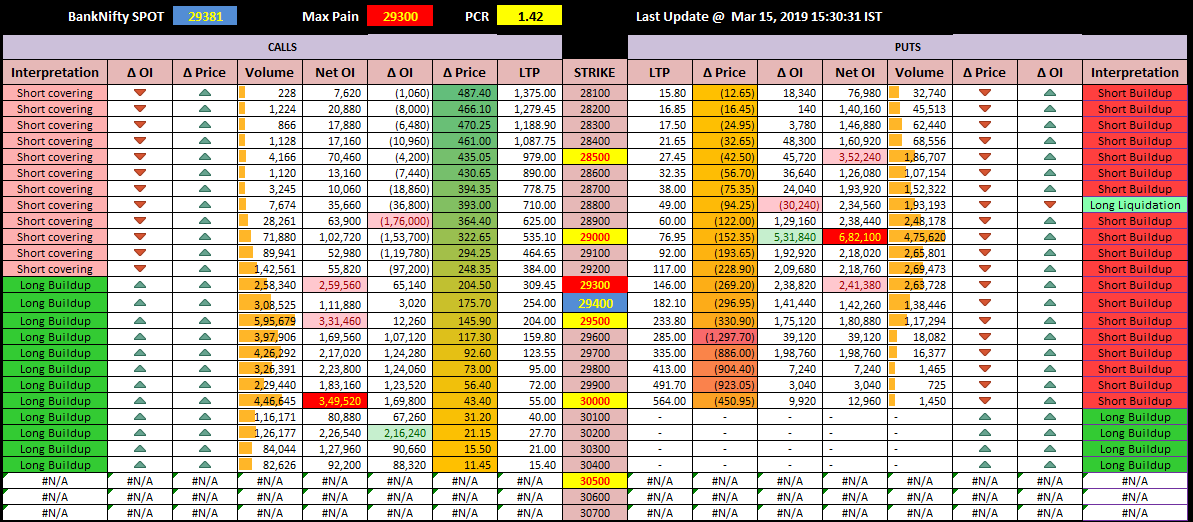

Option chain –There was good OI addition across both PEs and CEs at various levels. 29300, 29500 and 30000 act as the resistance on the CE side while 28500, 29000 and 29300 act as critical support. Also the key levels to watch for – 28646, 28730, 28815, 28900, 28985, 29070, 29156

Range – 29000 to 30000

Max Pain – 29300 (D-1: 28700, D-2: 28300, D-3: 27900, D-4: 27700)

PCR – 1.42

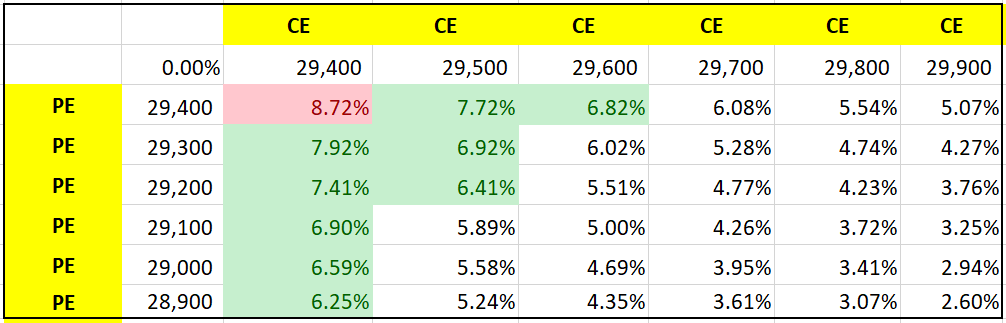

Strangle and Straddle Returns Table

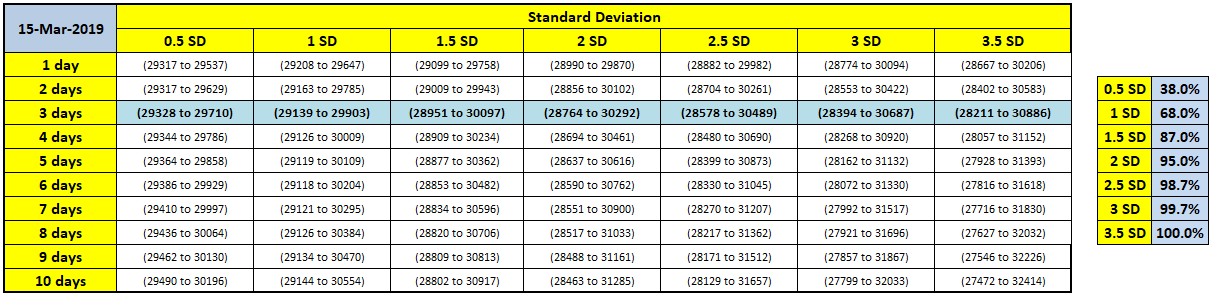

BankNifty BN expected movement with 0.5 SD to 3.5 SD (Reference – Previous day’s closing price)

Join our WhatsApp group now to get live updates about BankNifty BN Option Chain Analysis and more!