daily

BankNifty BN Option Chain Analysis – 7th March 2019

7th March 2019 – BankNifty started off at yesterday’s close, and it was moving sideways until the second half. It managed to breach the 3rd Fibonacci level of 27,780. It was an expiry with a good movement in the end. Option chain – A good amount of OI was added on both call and put …

BankNifty BN Option Chain Analysis – 7th March 2019 Read More »

BankNifty BN expected movement with 0.5 SD to 3.5 SD – 6th March 2019

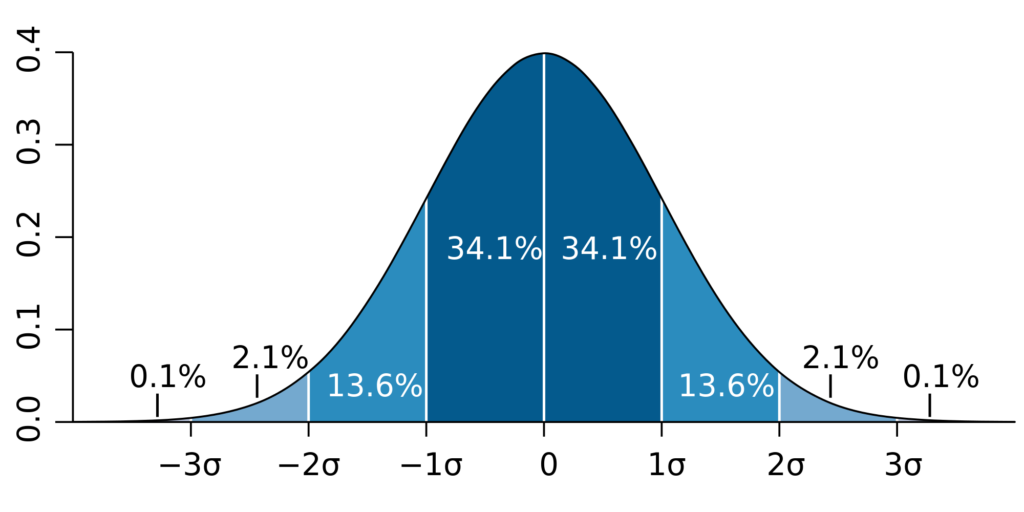

Expected movement with 0.5 SD to 3.5 SD. Do buy equal lots of PE and CE at a suitable distance as a hedge. Use it at your own risk!

BankNifty BN Short Straddle & Strangle returns – 6th March 2019

Naked Short Strangle Returns table – The ATM straddles gives a return of as high as 3%. Do buy equal lots of PE and CE at a suitable distance as a hedge. Use it at your own risk!

BankNifty BN Option Chain Analysis – 6th March 2019

6th March 2019 – BankNifty started off with a gap up, and was unable to breach the Fibonacci level 1 at 27,740. There was a bit of consolidation in both the indexes until 1:30 PM, and a slight recovery towards the end. 27,750 was the recent high and it will be interesting to see if …

BankNifty BN Option Chain Analysis – 6th March 2019 Read More »

BankNifty BN expected movement with 0.5 SD to 3.5 SD – 5th March 2019

Expected movement with 0.5 SD to 3.5 SD. Do buy equal lots of PE and CE at a suitable distance as a hedge. Use it at your own risk!

BankNifty BN Short Straddle & Strangle returns – 5th March 2019

Naked Short Strangle Returns table – The ATM straddles gives a return of as high as 4.8%. Do buy equal lots of PE and CE at a suitable distance as a hedge. Use it at your own risk!

BankNifty BN Option Chain Analysis – 5th March 2019

5th March 2019 – After a quiet start for the index, Banknifty rallied almost 2% from the day’s open. A lot of sentiments (Oil supply increase via Libya’s largest oil field, China’s growth forecast, INR recovery, border tensions-general elections) helped move the index and end on a very high note. Option chain – On the …

BankNifty BN Option Chain Analysis – 5th March 2019 Read More »

BankNifty BN expected movement with 0.5 SD to 3.5 SD – 1st March 2019

Expected movement with 0.5 SD to 3.5 SD. Do buy equal lots of PE and CE at a suitable distance as a hedge. Use it at your own risk!

BankNifty BN Short Straddle & Strangle returns – 1st March 2019

Naked Short Strangle Returns table – The ATM straddles gives a return of as high as 7%. Do buy equal lots of PE and CE at a suitable distance as a hedge. Use it at your own risk!