Our BankNifty Option Selling Strategy is explained here.

Our performance can be seen here. We made a profit close to 81% (on a capital of 15 lakh rupees) in 11 months. We provide training for options traders. Learn option trading and start earning a passive weekly/monthly income, make your own fortune!

4th February 2020

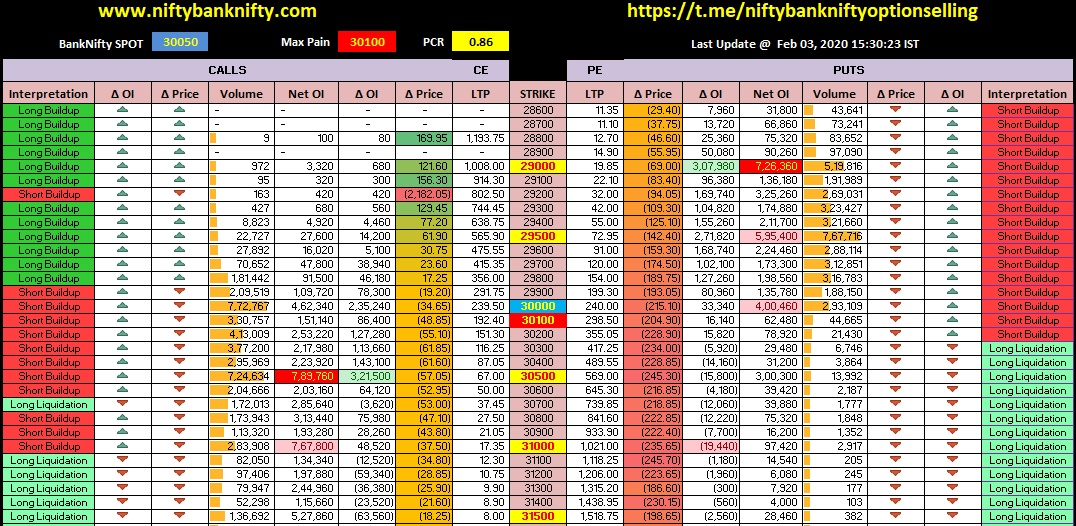

Key Levels for BankNifty SPOT to watch for – 29018, 29360, 29704, 30050, 30397, 30747, 31099 – these levels act as strong support/ resistance

Range – 29000 to 30500 – from the BankNifty Open Interest charts

Top 3 OI levels on the PE side – 29000 , 29500 , 30000

Top 3 OI levels on the CE side – 30500 , 31000 , 30000

Max Pain – 30100

Put-Call Ratio (PCR) – 0.86 (1.3 bearish reversal, 0.5 bullish reversal)

Explanation to this table here – http://bit.ly/nbn_optionchain

Also, this table is LIVE here – http://bit.ly/nbn_bnoptionchainlive

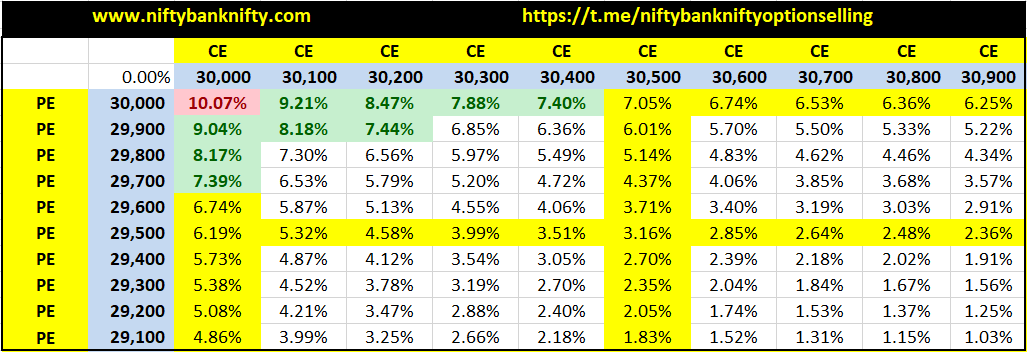

Strangle and Straddle Returns Table

Explanation to this table here – http://bit.ly/nbn_returnstable

Also, this table is LIVE here – http://bit.ly/nbn_bnreturnstablelive

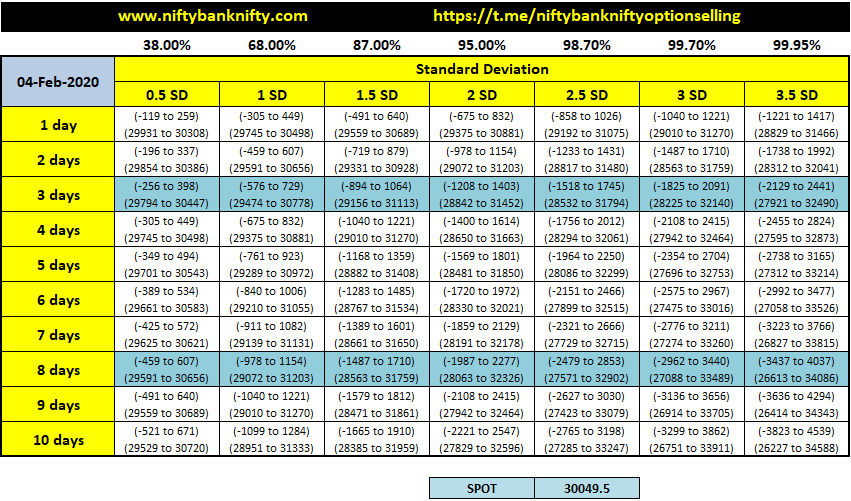

BankNifty BN expected movement with 0.5 SD to 3.5 SD (Reference – Previous day’s closing price)

Explanation to this table here – NBN Standard Deviation Table explained

For any queries, do post your questions here in our QnA forum here – http://bit.ly/nbn_tradingqna )

Join our Telegram group now.

Join our Telegram group now.

![]() Join our WhatsApp group now to get live updates about BankNifty BN Options trading and more!

Join our WhatsApp group now to get live updates about BankNifty BN Options trading and more!

Please post your comments/ feedback in the section below. Thanks.